Investments which have a fixed or variable rate of interest are one of the simplest and most common

form of investments available. Interest bearing investments include your bank account, a

certificate of deposit, or any other kind of investment in which you receive interest from the

principal. This section will describe how to handle these kinds of investments in GnuCash.

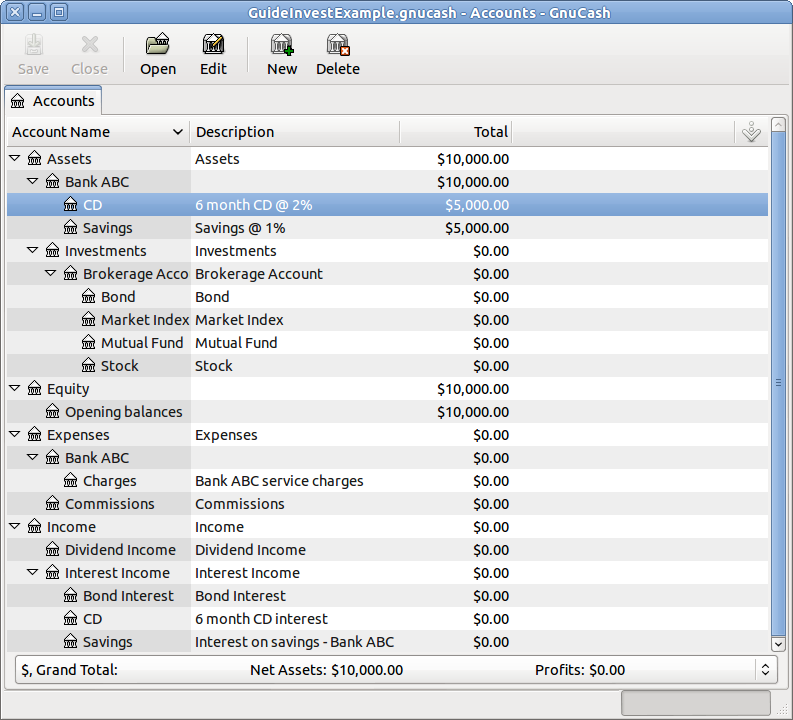

When you purchase the interest bearing investment, you must create an asset account to record the purchase of the investment, an income account to record earnings from interest, and an expense account to record bank charges. Below is an account layout example, in which you have an interest bearing savings account and a certificate of deposit at your bank.

Assets

Bank ABC

Certificate of Deposit

Savings

Expenses

Bank ABC

Charges

Income

Interest Income

Certificate of Deposit

SavingsAs usual, this account hierarchy is simply presented as an example, you should create your accounts in a form which best matches your actual situation.

Now let’s populate these accounts with real numbers. Let’s assume that you start with $10,000 in your bank account, which pays 1% interest and you buy a $5,000 certificate of deposit with a 6 month maturity date and a 2% yield. Clearly, it is much better to keep your money in the certificate of deposit than in the savings account. After the initial purchase, your accounts should look something like this:

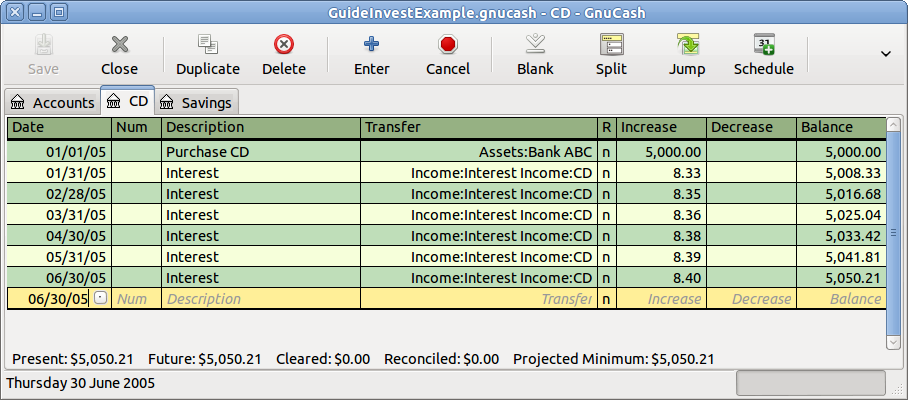

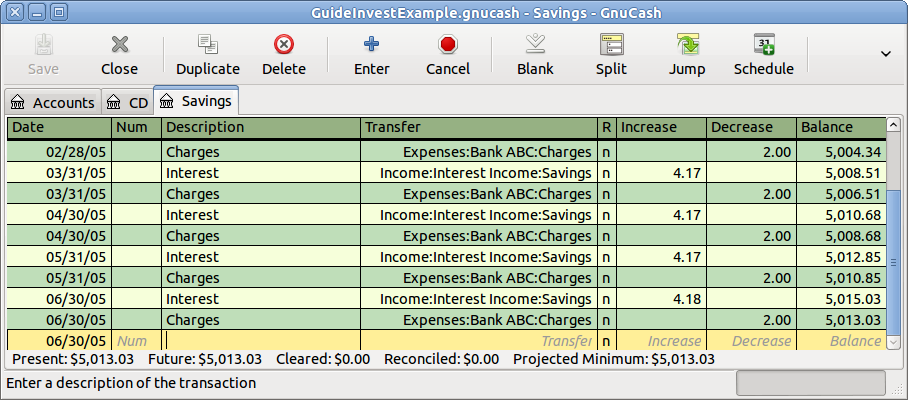

Now, during the course of the next 6 months, you receive monthly bank statements which describe the activity of your account. In our fictional example, we do nothing with the money at this bank, so the only activity is income from interest and bank charges. The monthly bank charges are $2. After 6 months, the register window for the certificate of deposit and for the savings account should look like these:

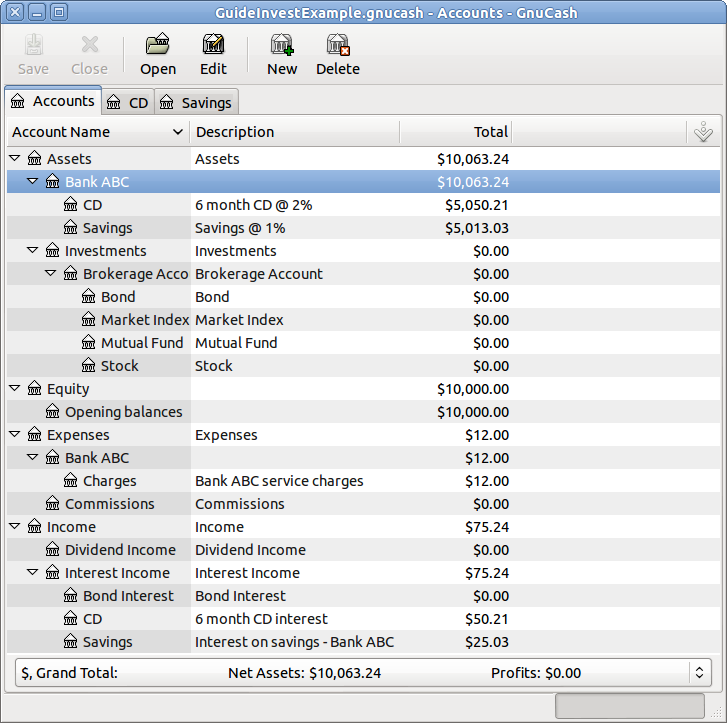

And this is the main GnuCash account window:

From the above image of the main GnuCash account window you see a nice summary of what happened to

these investments over the 6 months. While the yield on the certificate of deposit is double that of the savings

account, the return on the certificate of deposit was $50.21 versus $13.03 for the savings account, or almost 4

times more. Why? Because of the pesky $2 bank charges that hit the savings account (which

counted for $12 over 6 months).

After this 6 month period, the certificate of deposit has reached maturity which means you may sell it with no early withdrawal penalty. To do so, simply transfer the $5,050.21 from the certificate of deposit account into the savings account.