Some companies or mutual funds pay periodic dividends to shareholders. Dividends are typically given in one of two ways, either they are automatically reinvested into the commodity or they are given as cash. Mutual funds are often setup to automatically reinvest the dividend, while common stock dividends usually pay cash.

If the dividend is presented as cash, you should record the transaction in the asset account that received the money, as income from Income:Dividends. Additionally if you want to tie the cash dividend to a particular stock holding then add a dummy transaction split to the stock account with quantity 0 price 1 value 0.

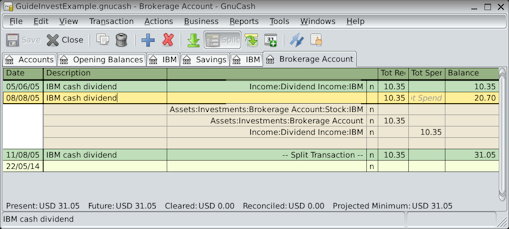

As an example consider the following; the dividends deposited as cash into the Broker Account with a tie to the stock account.

| Note |

|---|---|

If you want to track dividends on a per-stock basis, you would need to create an Income:Dividends:STOCKSYMBOL account for each stock you own that pays dividends. | |

If you receive the dividend in the form of an automatic reinvestment, the transaction for this should be handled within the stock or mutual fund account as income from Income:Dividends for the appropriate number of reinvested shares. This type of reinvest account is often referred to as a DRIP (Dividend Re-Investment Program).

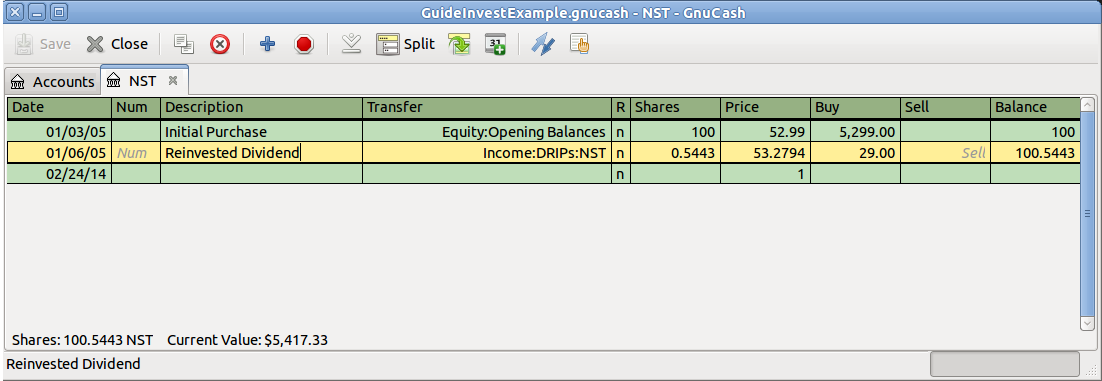

As an example consider the following purchase of NSTAR (NST) stock with the dividends reinvested into a DRIP Account. Mutual fund re-investments would be the same.

Starting with the purchase of 100 shares on Jan. 3, 2005, all dividends will be reinvested and an

account is created to track the dividend to the specific stock. GnuCash simplifies the entry

by allowing calculations within the cells of the transaction. If the first dividend is

$0.29/share, enter 53.28 (purchase price + dividend) in the share Price

cell and 100*0.29 in the Buy cell. GnuCash will calculate for you the

corresponding number of Shares.